The History of Diamond Value

The value of diamonds dates back to the 4th century BC. People have noticed this special and rare stone a long time ago. In ancient India, diamonds were regarded as a symbol of wealth. At that point, they become a currency of exchange. Later, diamonds became more and more popular among people, and gradually evolved into a symbol of power, and were restricted to only kings and royal families. Later, diamonds came to Europe along trade routes, and at that time, their value and charm fully blossomed.

Uncovering the mystery of diamond’s high value

A long-lasting treasure

As early as the Middle Ages, diamonds had become a precious asset of the European elite. At that time, the price of diamonds was already very expensive. At the end of the 19th century, a large number of diamond deposits were discovered in Kimberley, South Africa. From then on, the diamond market began to undergo tremendous changes. This discovery led to a significant increase in the supply of diamonds and the rise of the famous De Beers Consolidated Mining Company Limited.

20th century and beyond:

Diamonds became a marriage bundle, thanks to De Beers’ famous 1947 marketing campaign with the slogan “Diamonds are Forever.” At this point, the price and sales of diamonds have skyrocketed, making them a high-priced luxury item that people cannot afford.

The rarity of natural diamonds

Geological rarity: Natural diamonds are formed deep in the Earth’s mantle (approximately 140 to 190 kilometers below the surface) under extreme pressure and temperature conditions. This formation process takes one to three billion years, the formation conditions are limited, and it is only limited to the mantle area, making diamond geological minerals scarce.

Mining is difficult, costly and yields low

First of all, the mining locations for diamonds are limited. Currently, there are only countries such as Botswana, Russia, Canada and South Africa. They are rare and expensive, which is one of the reasons why diamonds are so expensive. Secondly, the diamond mining process is very costly, requiring a lot of geological exploration, large-scale mining and labor, which increases the cost of natural diamonds from the source.

Finally, the output rate of diamonds is extremely low. How low is it? A common statistic often quoted in the industry is that approximately 250 tons of ore need to be mined to produce a one-carat gem-quality diamond. You have to remember that one carat = 200 milligrams, so this ratio is an astonishing 1,250,000,000:1. With such a mining rate, it is difficult to justify the low price of diamonds.

Diamond Quality and Grading System

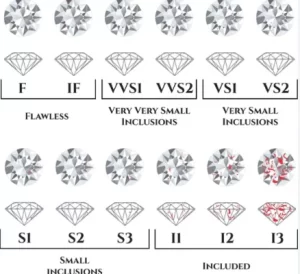

The quality of a diamond determines its pricing, and a diamond has its 4C quality standards, which are color, clarity, carat, and cut. These four quality standards are divided into different sub-levels, such as Color: D, E, F (colorless) G, H, I, J (nearly colorless) K, L, M (light yellow) N to R (very light yellow) and S to Z (light yellow) D absolutely colorless, most Rare and most expensive, other color grades are priced in descending order.

Clarity: Flawless (FL) and Internally Flawless (IF), Very Very Slightly Contained (VVS1 and VVS2), Very Slightly Contained (VS1 and VS2), Slightly Contained (SI1 and SI2), Noticeably Contained (I1, I2 and I3), diamonds with FL clarity grade are very rare and rarely seen on the market, while the price of IF grade diamonds is eye-poppingly high.

Market controls diamond prices

The global diamond market is tightly controlled by a few companies, which manage supply to maintain high prices and maximize their own profits. Even though the market has diversified in recent years, the legacy of this control still affects Price, unless impacted by other substitutes, the “monopoly” of diamonds will keep prices at a high level.

People’s willingness to buy diamonds

People all over the world want to buy diamonds. Originally they were only popular in Europe and the United States. Now Asian countries still show a strong intention to buy diamonds, especially India and China. This has also caused the diamond market to be in short supply. By the 20th century In the 21st century, the price of diamonds continues to rise, and the market is unprecedentedly prosperous. High prices cannot stop people’s desire to buy diamonds, so the price of diamonds has been growing, and they have always been expensive.

Future trends in the diamond industry

The diamond industry may be greatly impacted in the future, because today’s couples are no longer affected by the marketing of diamonds and marriage. They think that diamonds are just carbon, and there is no need to spend so much money to buy a carbon stone. Moreover, with the advancement of technology, artificial laboratory diamonds have entered the market with perfect color and clarity, and the price is very cheap compared to diamonds, which has greatly impacted the natural diamond market.

Therefore, it is very likely that laboratory diamonds will dominate the diamond industry in the future, and the price of diamonds will also fall. Diamonds will lose their asset properties and no longer maintain their value.

FAQs

- Why do diamonds of the same size have different prices?

If the clarity and color are different for the same size, the price difference will still be huge. The price of diamonds will be affected by the clarity and color grade. - How does a diamond’s cut affect its price?

A high-quality cut will make the refractive index and fire of the diamond higher, and the light will be more brilliant, so the price will be higher. - Are lab-grown diamonds cheaper than natural diamonds?

Yes, production costs are lower than mining natural diamonds, and the color and clarity grades of lab diamonds are controllable. - How does a diamond’s origin affect its price?

Diamonds from some mines are considered to be of higher quality and rarer. For example, diamonds from South Africa or Russia command a premium due to their long-standing reputation in the diamond industry. - Can the resale value of a diamond be predicted?

The diamond resale market in 2024 will be very bleak, basically buying high and selling low, and it may even be difficult to resell.